Life Insurance in and around Ardmore

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

Taking care of those you love is a big deal. You listen to their concerns help them make decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Put Those Worries To Rest

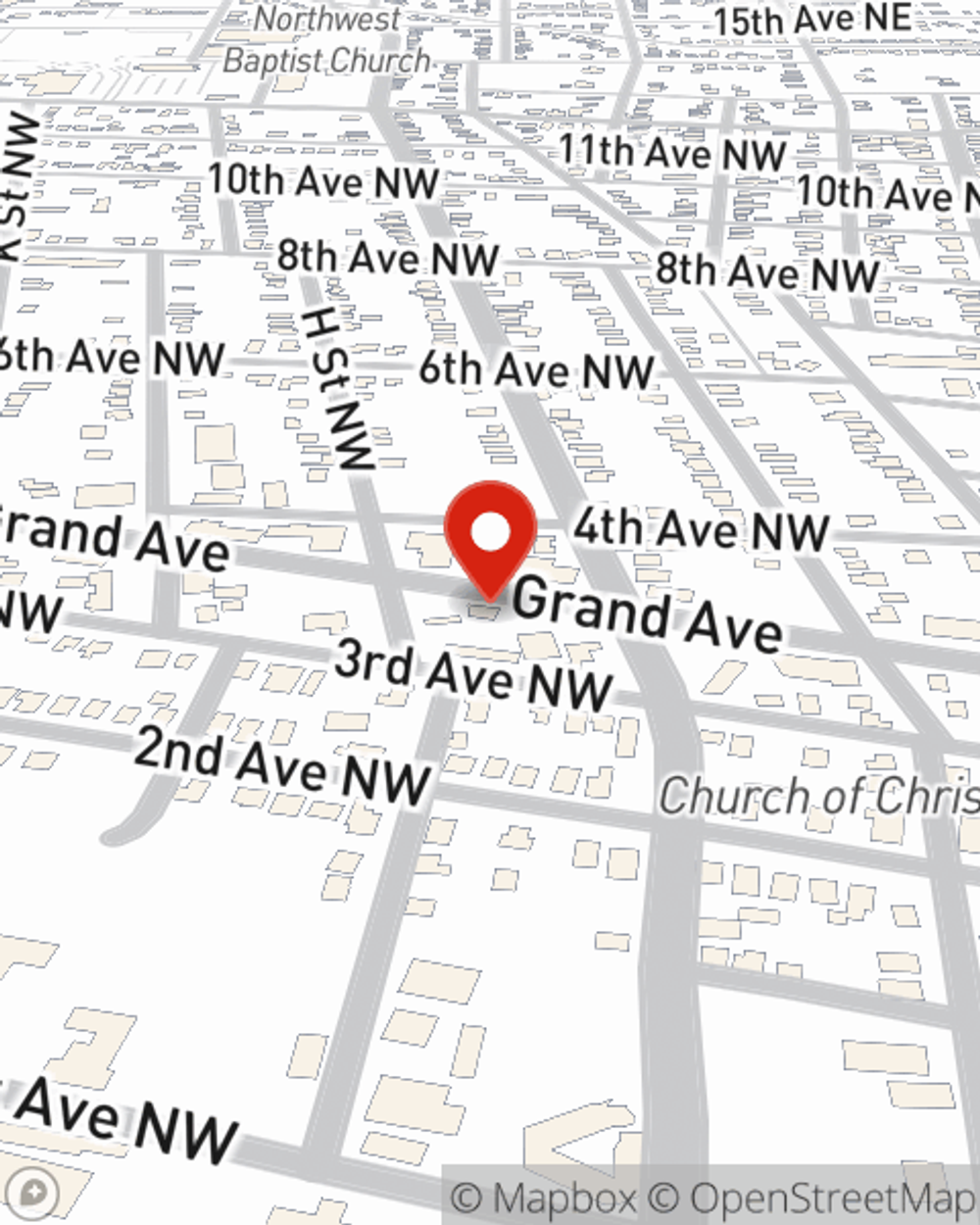

And State Farm Agent Tod Weder is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Tod Weder, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Tod at (580) 226-6400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.