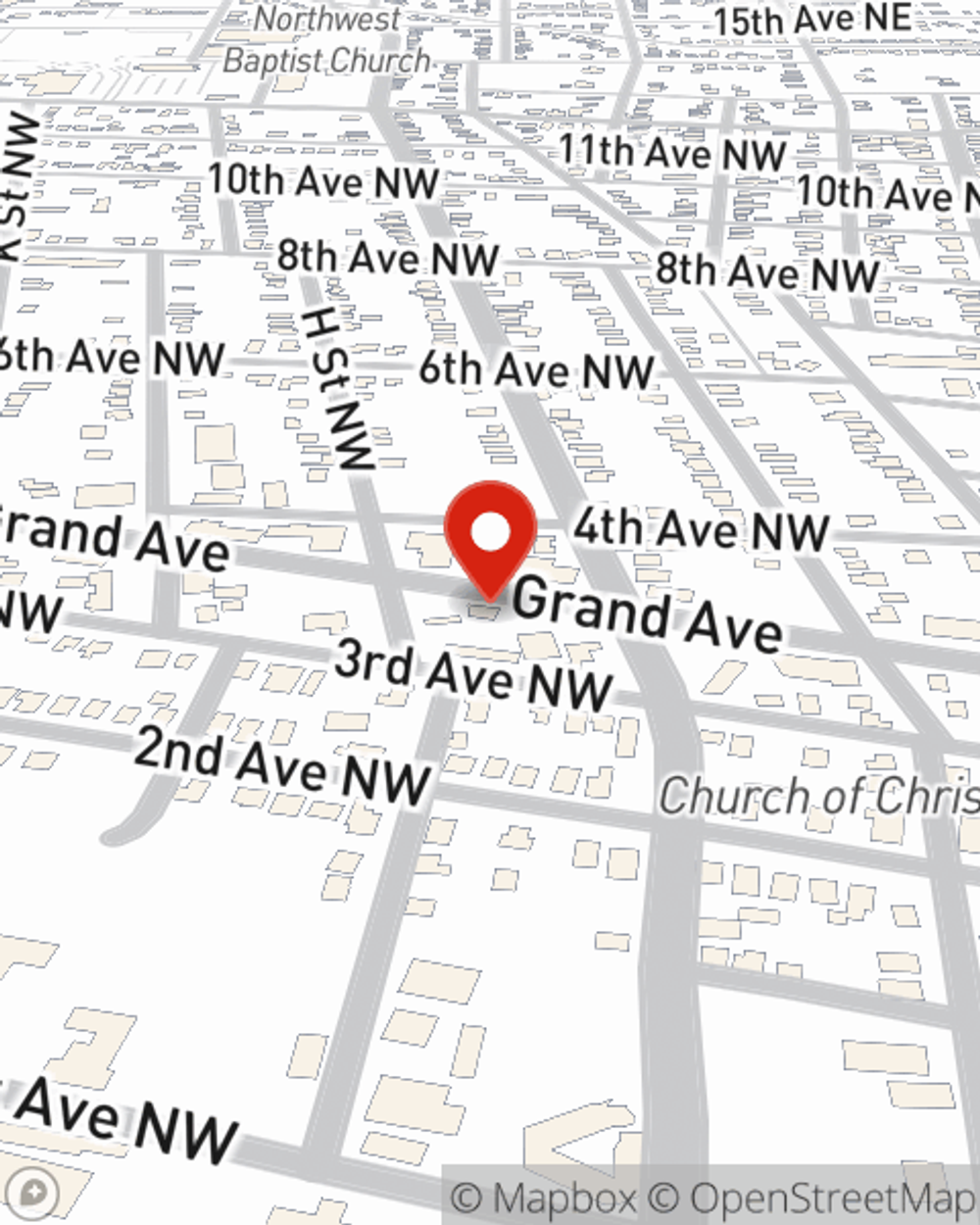

Business Insurance in and around Ardmore

One of the top small business insurance companies in Ardmore, and beyond.

This small business insurance is not risky

This Coverage Is Worth It.

Whether you own a an art gallery, a HVAC company, or a stained glass shop, State Farm has small business coverage that can help. That way, amid all the different decisions and moving pieces, you can focus on navigating the ups and downs of being a business owner.

One of the top small business insurance companies in Ardmore, and beyond.

This small business insurance is not risky

Get Down To Business With State Farm

Your small business is unique and faces specific challenges. Whether you are growing a fabric store or a toy store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Tod Weder can help with business continuity plans as well as professional liability insurance.

As a small business owner as well, agent Tod Weder understands that there is a lot on your plate. Reach out to Tod Weder today to review your options.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Tod Weder

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.